四个西方经济波动周期(基钦、朱格拉、库兹涅茨、康德拉季耶夫)

![]() 微wx笑

微wx笑 2023-01-16【金融知识】

2023-01-16【金融知识】

4

4 0关键字:

经济周期 基钦周期 朱格拉周期 建筑周期 康波周期

0关键字:

经济周期 基钦周期 朱格拉周期 建筑周期 康波周期

四个西方经济波动周期(基钦、朱格拉、库兹涅茨、康德拉季耶夫) 西方经济中一些经典的周期性。 一、基钦周期 The Kitchin cycle,3.33年 美国经济学家约瑟夫·基钦

四个西方经济波动周期(基钦、朱格拉、库兹涅茨、康德拉季耶夫)

西方经济中一些经典的周期性。

一、基钦周期 The Kitchin cycle,3.33年

美国经济学家约瑟夫·基钦(Joseph Kitchin)于1923年提出,经济小周期平均长度约41个月(3.4年)。

In 1923, Joseph Kitchin published in the Harvard University Press an article entitled “Review of Economic Statistics,” outlining his discovery of a 40-month cycle resulting from a study of U.S. and UK statistics from 1890 to 1922. At the same time as Kitchin was carrying out his investigation, a fellow Harvard professor, W.L.Crurn, found a cycle of 39, 40 or 41 months in commercial paper rates in New York. The Kitchin cycle is sometimes said to be based on a stocking/destocking cycle.

Richard Mogey of the Foundation for the Study of Cycles determined a cycle of 40.68 months over the entire history of US stock prices.

实际上,There is an interesting story related in Edward R. Dewey’s book, “Cycles: The Mysterious Forces that Trigger Events” about a group of investors on Wall Street in 1912. … Reputedly success followed, particularly when the group adapted their investment strategy to a 41-month stock cycle.

二、朱格拉周期 The Juglar cycle,8~11年

1862年法国医生、经济学家克里门特·朱格拉(Clément Juglar, Oct. 15, 1819, Paris, Fr.— died Feb. 28, 1905, Paris)在《论法国、英国和美国的商业危机以及发生周期》一书中首次提出。提出了市场经济存在着9~10年的周期波动。

The first authority to explore economic cycles as periodically recurring phenomena was the French physician and statistician Clément Juglar, who in 1860 identified cycles based on a periodicity of roughly 8 to 11 years.

The main features of medium-term cycles of business activity, or business cycles (7–11 years) that are also known as Juglar cycles after the prominent 19th-century French economist Clement Juglar (1819–1905), who investigated these cycles in detail (Juglar 1862, 1889).

Juglar Wave, a Cycle of 8 to 10 Years. In 1860, Clemant Juglar first observed a general economic cycle lasting 8 to 10 years, based on his study of data on banking, interest rates, stock prices, business failures, patents issued, pig iron prices, and a variety of other phenomena.

三、库兹涅茨周期 The Kuznets cycles,15~22年

美国经济学家、1971年诺贝尔经济学奖得主库兹涅茨·西蒙(Simon Smith Kuznets,April 30 1901 – July 8/9 1985),许多生产部门尤其是基础工业部门的经济增长率,约15到22年呈现有规则的波动,其原因是人口(特别是移民)的波动。

1930年美国经济学家西蒙·库兹涅兹在《生产和价格的长期运动》一书中提出。1930年美国经济学家库涅茨提出的一种为期15-25年,平均长度为20年左右的经济周期。由于该周期主要是以建筑业的兴旺和衰落这一周期性波动现象为标志加以划分的,所以也被称为“建筑周期”。

Kuznets carried out research on the U.S. real-estate cycle. He identified a cycle of 16.5 to 18 years.

The Kuznets swing (or Kuznets cycle) is a claimed medium-range economic wave with a period of 15–25 years identified in 1930 by Simon Kuznets.

四、康德拉季耶夫周期 The Kondratieff Wave,40~60年

1926年俄国经济学家尼古拉·康德拉季耶夫提出的一种为期50-60年的经济周期。

Nikolay D. Kondratyev, in full Nikolay Dmitriyevich Kondratyev, (born March 4, 1892—died 1938?), Russian economist and statistician noted among Western economists for his analysis and theory of major (50-year) business cycles—the so-called Kondratieff waves.

Kondratieff Wave, named after Russian economist Nikolai Kondratieff, refers to cycles, lasting about 40 to 60 years, experienced by capitalist economies. Also known as "Kondratiev waves," "super-cycles," "K-waves," "surges," and/or "long waves."

还有“体制释放周期(~30年)”?其它周期?

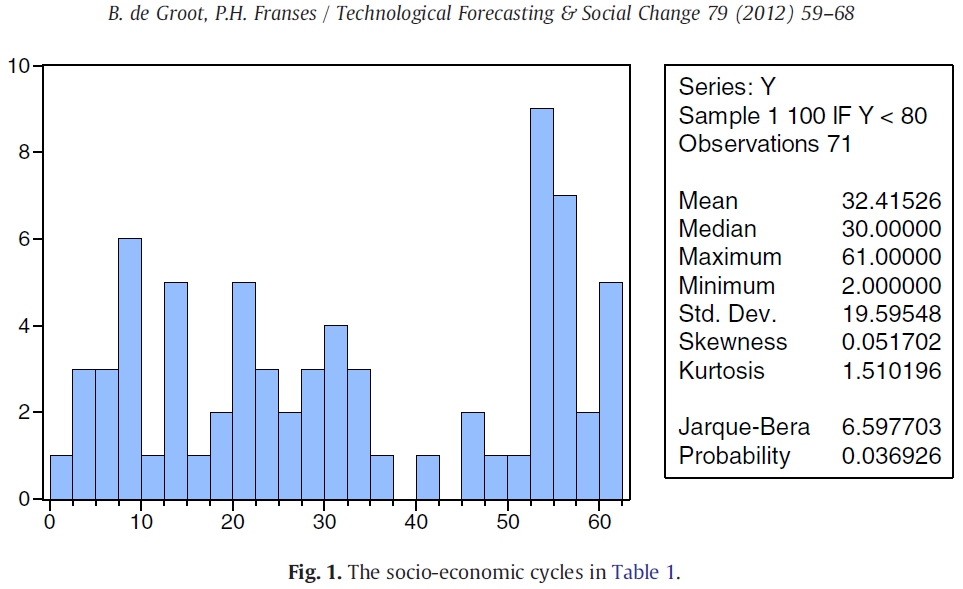

五、2012-01, Bert de Groot, Philip Hans Franses, Bert de Groot)Common socio-economic cycle periods

For the 71 socio-economic cycle periods we obtain empirical evidence that the data can be best described by a mixture of 4 normal distributions. The estimated means of these normal distributions appear in the first panel of Table 2. We find evidence of clusters around 8, 21, 32 and 55years.

参考资料:

[1] 基钦周期_百度百科

https://baike.baidu.com/item/%E5%9F%BA%E9%92%A6%E5%91%A8%E6%9C%9F

[2] Joseph Kitchin - Cycles Research Institute

https://cyclesresearchinstitute.org/cycles-research/economy/kitchin/

[3] 朱格拉周期_百度百科

https://baike.baidu.com/item/%E6%9C%B1%E6%A0%BC%E6%8B%89%E5%91%A8%E6%9C%9F

[4] Business cycle | Britannica

https://www.britannica.com/topic/business-cycle

[5] A mathematical model of juglar cycles and the current global crisis

[6] 库兹涅茨周期_百度百科

https://baike.baidu.com/item/%E5%BA%93%E5%85%B9%E6%B6%85%E8%8C%A8%E5%91%A8%E6%9C%9F

[7] Simon Kuznets - Facts - NobelPrize.org

https://www.nobelprize.org/prizes/economic-sciences/1971/kuznets/facts/

[8] Simon Kuznets | Biography, Nobel Prize, & Facts | Britannica

https://www.britannica.com/biography/Simon-Kuznets

[9] Kuznets - Cycles Research Institute

https://cyclesresearchinstitute.org/cycles-research/economy/kuznets/

[10] 康德拉季耶夫周期_百度百科

[11] Nikolay D. Kondratyev | Russian economist | Britannica

https://www.britannica.com/biography/Nikolay-D-Kondratyev

[12] Kondratieff - Cycles Research Institute

https://cyclesresearchinstitute.org/cycles-research/economy/kondratieff/

[13] 经济周期(Business Cycle)_百度百科

https://baike.baidu.com/item/%E7%BB%8F%E6%B5%8E%E5%91%A8%E6%9C%9F

推荐阅读:

[1] 武夷山,2013-05-04,社会经济变量的周期

http://blog.sciencenet.cn/blog-1557-686558.html

这些周期都聚合在8年、21年、32年和55年周围。

[2] Common socio-economic cycle periods [J]. de Groot, Bert (Econometric Institute, Erasmus University, Rotterdam, Netherlands); Franses, Philip Hans Source: Technological Forecasting and Social Change, v 79, n 1, p 59-68, January 2012

https://linkinghub.elsevier.com/retrieve/pii/S0040162511001302

Most well-known cycles are those named after of Kitchin, Juglar, Kuznets and Kondratieff, but there are many more.

If we fit a mixture of normal distributions on the cycle periods, we find that these cycle periods are clustered around 8, 21, 32 and 55 years.

相关链接:

[1] 2014-12-03,经典经济周期,俄罗斯大事,北半球气温

http://blog.sciencenet.cn/blog-107667-848204.html

[2] 2014-12-25,科学发展周期性的研究概况(《科技导报》)

杨正瓴. 科学发展周期性的研究概况[J]. 科技导报, 2014, 32(35): 88-88.

http://blog.sciencenet.cn/blog-107667-853868.html

http://www.kjdb.org/CN/abstract/abstract12297.shtml

转自:https://wap.sciencenet.cn/blog-107667-1233904.html?mobile=1

本文为转载文章,版权归原作者所有,不代表本站立场和观点。

上一篇:上交所主板规范类强制退市